Credit and Debt Management Techniques: Take Charge With Clarity and Confidence

Chosen theme: Credit and Debt Management Techniques. Welcome to a practical, judgment-free space where plan beats panic, smart habits beat high interest, and you build lasting financial calm one small decision at a time.

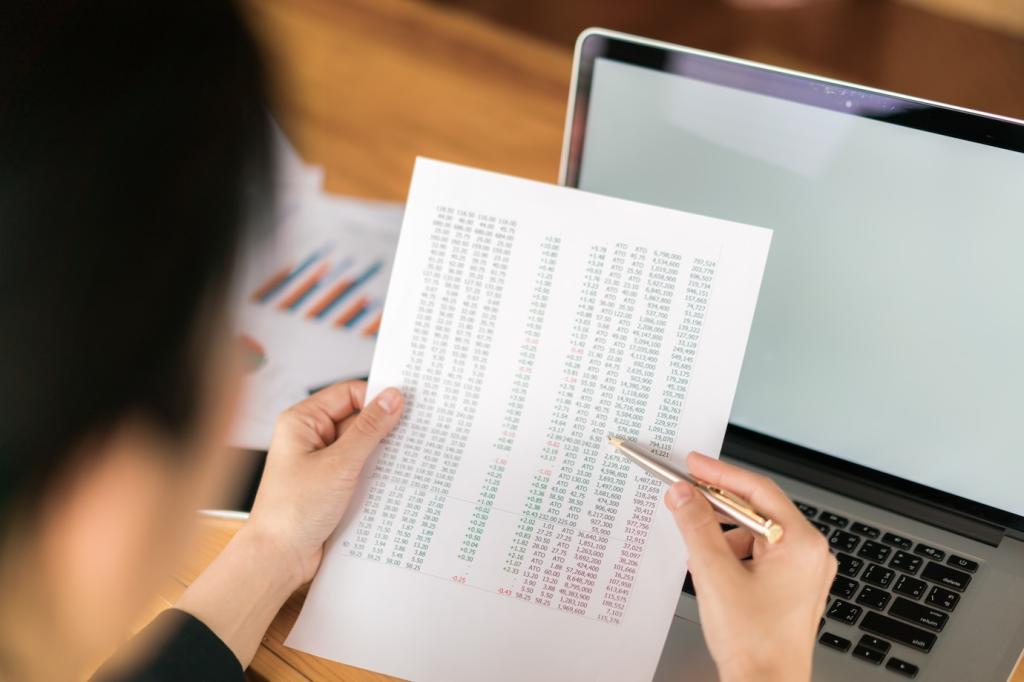

List Every Balance and APR

Open each statement and capture balance, APR, credit limit, and any promo period. High rates quietly compound, so naming them reduces stress and reveals quick wins. Comment if you want our printable tracking sheet.

Map Due Dates and Minimums

A simple calendar reduces late fees and protects your credit score. Highlight dates, set two reminders, and align payments with paydays. Share your scheduling method below—your idea might help someone avoid a penalty.

Prioritization Methods: Avalanche vs. Snowball

Avalanche: Crush High Interest First

Direct extra payments to the highest APR while paying minimums elsewhere. This minimizes total interest and often shortens payoff time. If you love efficiency and math-backed progress, avalanche delivers. Tell us your top APR below.

Snowball: Win With Quick Momentum

Pay off the smallest balance first to enjoy fast victories, then roll that payment into the next debt. Small wins fuel motivation, especially early on. Share your first snowball target and celebrate that coming zero.

Hybrid Strategy: Personalize Your Plan

Blend both: clear a tiny balance for encouragement, then pivot to high-interest accounts. Personal finance should fit your psychology. Comment with your hybrid approach, and subscribe for a checklist to switch strategies smoothly.

Optimizing Credit: Utilization, Limits, and Score Health

Credit utilization is your balance divided by limit. Aim below 30%, and lower is stronger. Consider mid-cycle payments before statements close. Drop a comment if you want our reminder script to time payments perfectly.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Cash Flow Systems: Budgets That Actually Stick

Assign every dollar a job, then add small buffers for irregular expenses. Flex funds prevent guilt and keep momentum. Comment your top three categories, and we’ll send a sample layout to copy in minutes.

Cash Flow Systems: Budgets That Actually Stick

Automate a modest savings transfer to break the emergency–credit card cycle. A tiny cushion prevents setbacks. Share your target amount, and subscribe for our step-by-step guide to balancing savings with aggressive payoff.

Cash Flow Systems: Budgets That Actually Stick

Set autopay to minimums, then schedule manual extra payments for strategy. Add recurring reminders the day after payday. Tell us your bank’s best automation feature so we can feature community hacks next week.

Maya’s 12-Month Turnaround

Maya automated minimums, sold two gadgets, and funneled every extra dollar to one card. Twelve months later, she cleared $9,800. Share your first milestone below; we’ll cheer and feature reader wins in our newsletter.

Community Accountability Works

Posting monthly totals keeps momentum strong. Comment your starting balance and target date, then check in next month. We’ll provide a gentle nudge and a progress badge to keep encouragement visible and consistent.

Celebrate Micro-Wins and Share Yours

Did you avoid a late fee, negotiate a lower APR, or cut one subscription? That matters. Drop your micro-win in the comments and subscribe for a Friday roundup packed with practical, real-life encouragement.